The AARP estimates a 50% chance that you will have long-term care expenses one day…

Read MoreConsumer spending plays a huge role in the U.S. economy... When you couple the fact that more Americans started working again in the first quarter with the latest round of stimulus checks, it’s not too surprising that retail sales also surged in the past three months.

Read MoreWhile we’re all pleased that the U.S. economy is rebounding strongly from the global pandemic, the rapid recovery has spurred expectations for inflation to increase. Federal Reserve Chairman Jerome Powell stoked these expectations in recent comments…

Read MoreAccording to Fidelity, many retirement savers took advantage of the increased contribution limits for 401(k)s and IRAs last year. Fidelity reported that one in three savers boosted their 401(k) contribution in 2020; IRA contributions jumped 35% last year

Read MoreFor many Americans, there are three primary sources of income in retirement: Social Security, pensions, and personal savings…

Read MoreYou need to realize that much of the risk associated with the junk bond market is equity-like risk. For our money, we would rather be able to realize an equity return if we take equity risk.

Read MoreThe elevated level of margin debt has sparked concerns and fears of bubbles on Wall Street. Some investors are even calling for the Federal Reserve to adjust its margin requirements.

Read MoreHow he is positioned is anyone’s guess, but a continued rash of selling in the Treasury market could certainly be bad for both bonds and stocks, and that could be bad for Tepper.

Read MoreNo good can come from blaming one generation for another generation's woes. If the divide continues to widen, the fallout could be detrimental to the economy, stock market, and, most importantly, our society overall.

Read MoreWhy then is the bond market moving? Why are we seeing interest rates rising? According to Yahoo Finance, this year, we have witnessed long-dated rates jump more than 50 basis points.

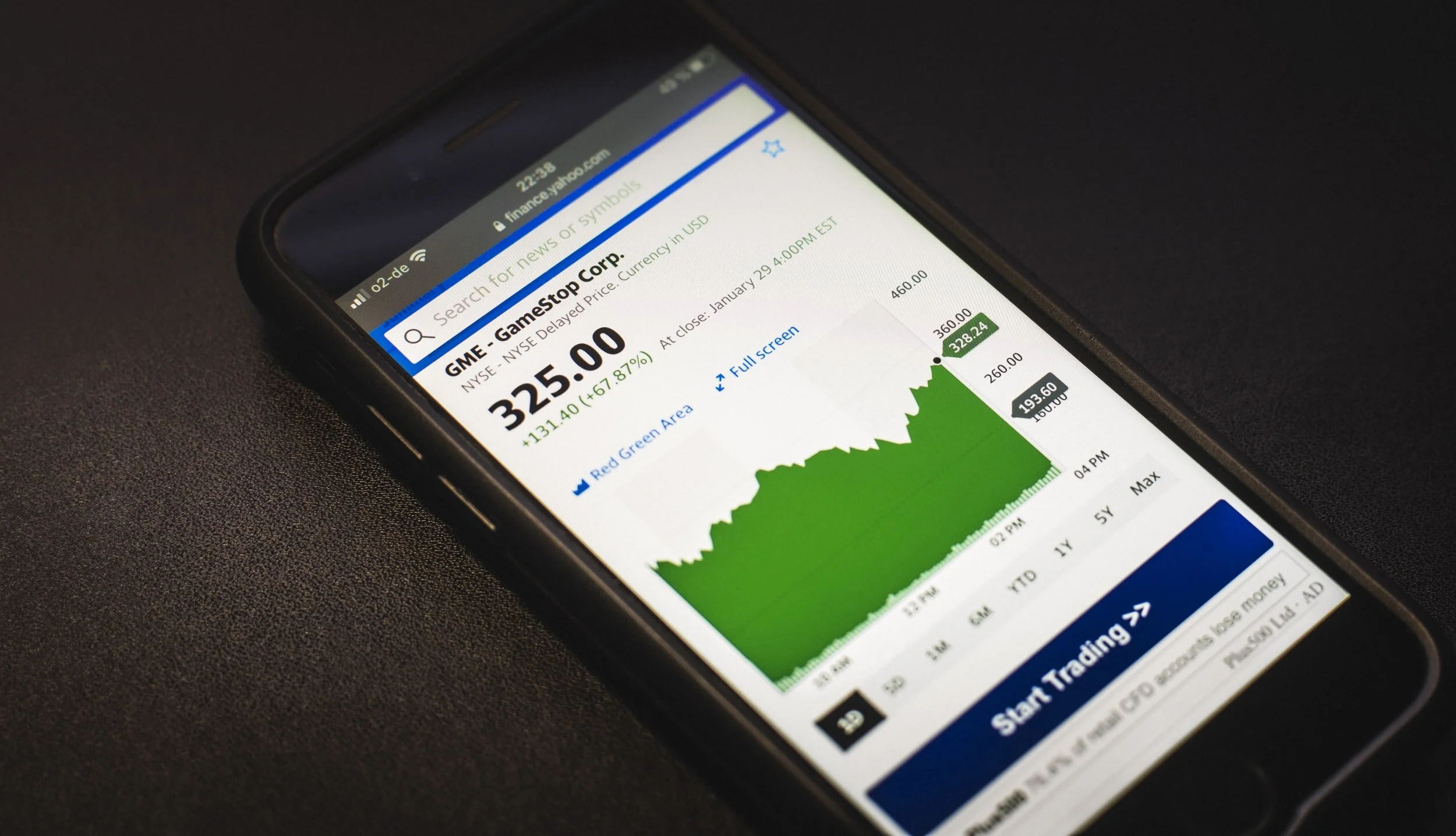

Read MoreBrokers like Robinhood often utilize a "payment for order flow" strategy. Simply put, the broker receives payment for executing the trade through a market maker… But here's what's important to understand: the trades aren't made on the stock exchange.

Read MoreThe advantage to owning individual bonds is you are not forced to take losses; you can structure your bond portfolio to meet your needs and expectations.

Read MoreThe competition is now nipping at Tesla's heels, and it will be interesting to see if one of the "turtles" pulls ahead in the upcoming months and years…

Read MoreThe reality is that bonds tend to perform well in periods of declining Treasury yields, which is why many income investors poured into high-yield corporate and government bond funds last year. But, in my opinion, bond funds aren’t a “safe” investment…

Read MoreOver the years, many politicians have used the national debt size to accuse opponents of reckless spending and mortgaging our children’s futures. However, once in power, neither political party has done much to cut the spending that grows our nation’s debt.

Read MoreWith the first month of 2021 in the rearview mirror, many Wall Streeters are now wondering if January’s volatility will be a precedent for the rest of the year

Read MoreAs was demonstrated on January 6 at our nation’s capital, a mob is capable of many things

Read MoreTo combat the out-of-control deficit, President Biden is determined to raise taxes

Read MoreThe market does not care who is in power, and there is no empirical evidence to suggest otherwise.

Read MoreYou can think of a DAF as your own personal charitable giving savings account

Read More